Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

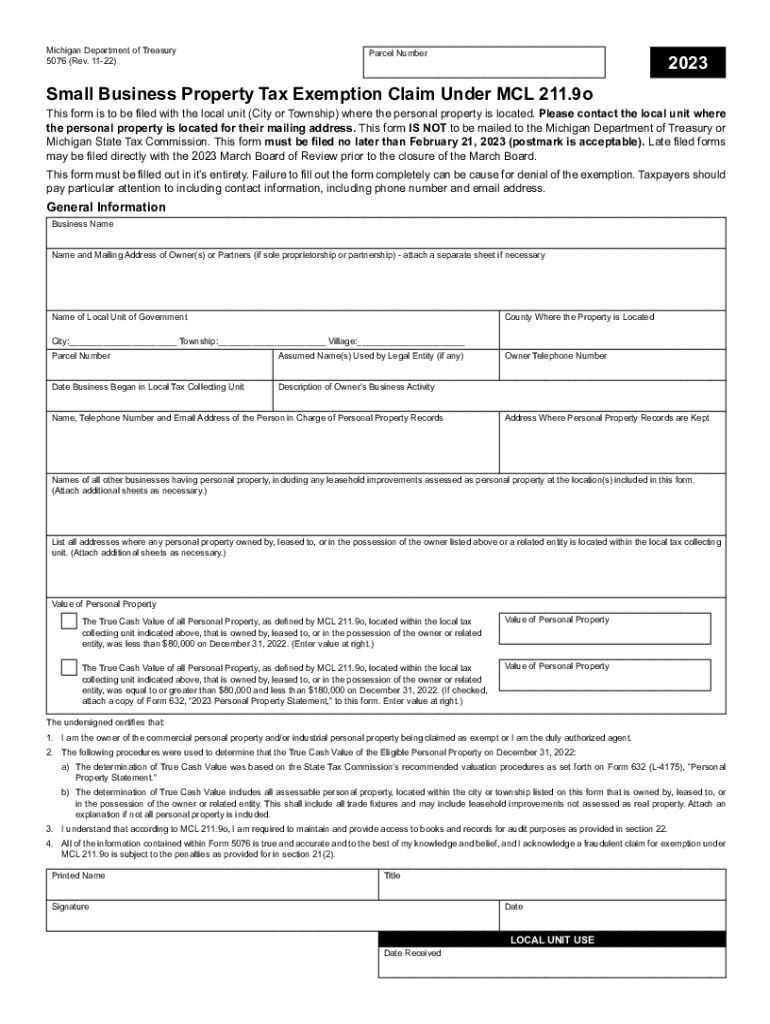

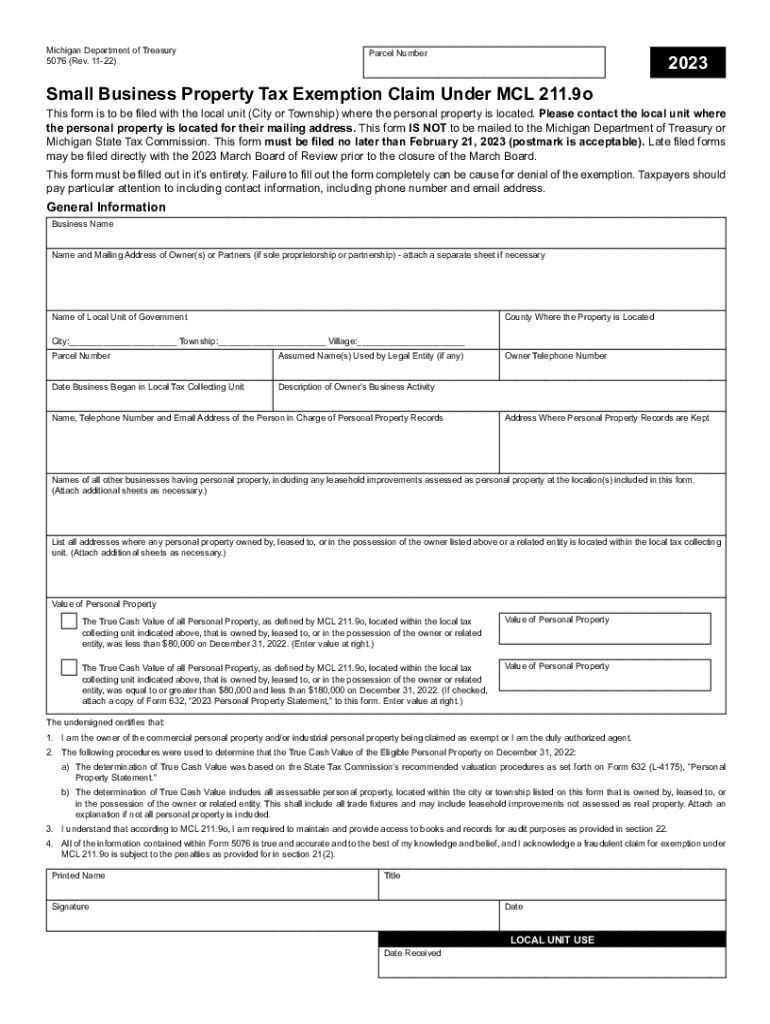

What is mi property exemption?

Mi property exemption is a program offered by the state of Michigan that exempts a portion of the value of a person's primary residence from taxation. The program is intended to help make housing more affordable for Michigan residents. The amount of the exemption varies from county to county and is based on the median value of homes in each county.

What is the purpose of mi property exemption?

The Michigan Property Tax Exemption is a program offered by the state of Michigan that provides a property tax exemption to individuals who meet certain eligibility requirements. The purpose of the program is to provide tax relief to individuals who are elderly, disabled, veterans, or who are low-income.

When is the deadline to file mi property exemption in 2023?

The deadline to file your Michigan property exemption in 2023 is March 1st.

Who is required to file mi property exemption?

In the context of property tax exemptions, the specific requirements for filing a property exemption vary by state and even by municipality. However, generally, property owners are required to file for property tax exemptions in order to be considered for exemption status. The eligibility for exemptions can depend on various factors such as the type of property (residential or commercial), the age of the owner, their income status, veteran status, disabilities, etc. It is advisable for property owners to check with their local tax assessor's office or the relevant government agency to determine the specific requirements and procedures for filing a property exemption in their area.

How to fill out mi property exemption?

To fill out a property exemption form in Michigan, follow these steps:

1. Obtain the correct form: Visit the Michigan Department of Treasury website or contact your local assessor's office to request the appropriate property tax exemption form.

2. Provide your personal information: Enter your full legal name, mailing address, and contact information at the top of the form.

3. Identify the property: Fill in the property's address, including street, city, county, and ZIP code. Specify whether the property is your primary residence or owned by a nonprofit organization.

4. Determine the exemption category: Choose the category that applies to you from the available options, such as Disabled Veterans Exemption, Principal Residence Exemption (PRE), or Agricultural Property Exemption, among others. Review the specific eligibility requirements and understand the documentation needed for each exemption.

5. Complete the required sections: Carefully fill out all the sections relevant to your exemption category. This may include supplying personal details, supporting documentation, and signing the form.

6. Provide supporting documentation: As mentioned earlier, certain exemptions may require additional documentation. Examples include proof of disability, proof of ownership or tenancy, and related financial information. Gather all the required paperwork and submit it along with your exemption form, if applicable.

7. Review and sign: Go through the form one more time to ensure all information is accurate and complete. Append your signature and the date at the bottom.

8. Submit the form: Make a copy of the completed form and all supporting documents for your records. Then, submit the originals to your local assessor's office either in person, via mail, or electronically, depending on their preferred method.

It is crucial to carefully read the instructions on the form and any accompanying guidelines or requirements to ensure you provide accurate information and meet all necessary criteria. If you have any doubts or need clarification, it is advisable to contact your local assessor's office for assistance.

What information must be reported on mi property exemption?

The specific information that must be reported on a property exemption may vary depending on the jurisdiction. However, some common information that is typically required to be reported on a property exemption includes:

1. Property owner's name and contact information: This includes the full legal name of the property owner(s), mailing address, phone number, and email address.

2. Property address and legal description: The physical address of the property, along with its legal description, should be provided. The legal description usually includes the lot number, block number, subdivision name (if applicable), and any other relevant details.

3. Property type and use: The type of property (e.g., residential, commercial, agricultural) along with its current use (e.g., primary residence, rental property) should be stated.

4. Assessed value: The assessed value of the property, as determined by the local tax assessor's office, must be reported. This value serves as the basis for determining the eligibility for the exemption.

5. Exemption type: The specific type of exemption being claimed should be indicated. There are various types of property exemptions available, such as homestead exemption, senior citizen exemption, disability exemption, veterans exemption, etc.

6. Supporting documents: In many cases, supporting documents may need to be submitted along with the exemption application. These documents typically include proof of ownership (e.g., deed, title), proof of residence (e.g., utility bills, driver's license), and any other documentation required by the local tax authority to verify eligibility for the exemption.

It's important to note that the above information is not exhaustive, and the requirements for reporting on a property exemption may differ depending on local laws and regulations. It's recommended to consult the relevant tax authority or refer to the specific exemption application form for accurate and up-to-date information.

What is the penalty for the late filing of mi property exemption?

The penalty for late filing of a property exemption in Michigan can vary depending on the specific type of exemption and the local jurisdiction. However, generally, if a property owner fails to file for an exemption by the designated deadline, they may be subject to a penalty or a delay in receiving the exemption. It is recommended to contact the local assessor's office or the Michigan Department of Treasury for specific information regarding penalties for late filing of property exemptions in Michigan.

How do I edit 2023 form 5076 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing michigan form 5076 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit mi exemption straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit mi exemption.

How do I complete mi form 5076 for 2023 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form 5076 for 2023. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.